Here is latest and simple way to link aadhaar card with PAN. There is too much fury over linking of Aadhar Card with PAN Card, that even the official websites have crashed multiple times. As there is the common belief among masses that if they would not link their PAN Card with Aadhar Number before 1 July, their PAN card will become invalid. Well, that is true but not like it is being interpreted by the masses. The advisory clearly means, that linking will be mandatory from July 1, and it doesn’t mean the old PAN Cards that were not linked before 1 July will go invalid. There are more than 25 crore PAN card holders whereas 111 Crore Aadhaar Card holders. The Supreme Court recently granted partial relief to masses striking down the government decision that any PAN card will be made invalid if not linked to an Aadhaar by July 1. Now, as 1st July 2017, hits our calendar, it would be mandatory to link both the documents sooner or later, and the government has not announced any deadline for this process.

The linking process is very easy. You have to register yourself on Income Tax Filing website https://incometaxindiaefiling.gov.in/ first, then you will need to click on ‘link Aadhar’ option in Profile Settings. After matching details on both your documents, you can click “Link Now” and a confirmation message will pop-up confirming the same. If you are not much tech-savvy you can also link these two by sending an SMS to 567678 or 56161 from the mobile number registered with your Aadhaar card.

Steps to link Aadhaar Card with PAN Card using SMS or Income Tax E-filing portal without login:

The tax department has made provision for assessees to link their PAN card to Aadhaar Card by using the e-filing portal. They just need to follow the following step to step guide:

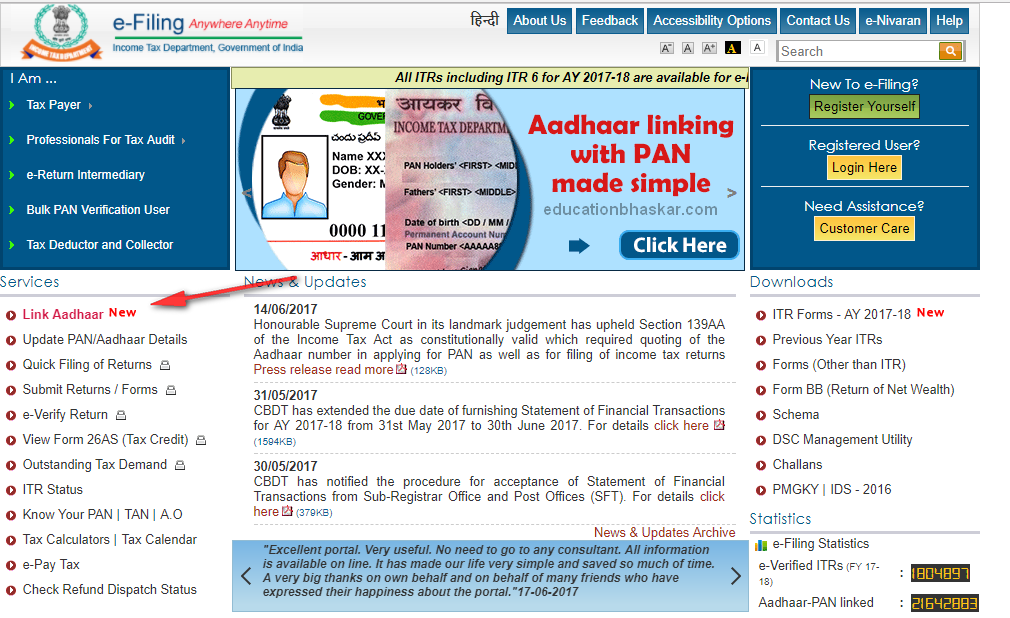

- Step 1: Assessees required to open the official website i.e. income tax e-filing portal at with URL https://incometaxindiaefiling.gov.in/ and click on the link label with “Link Aadhaar“.

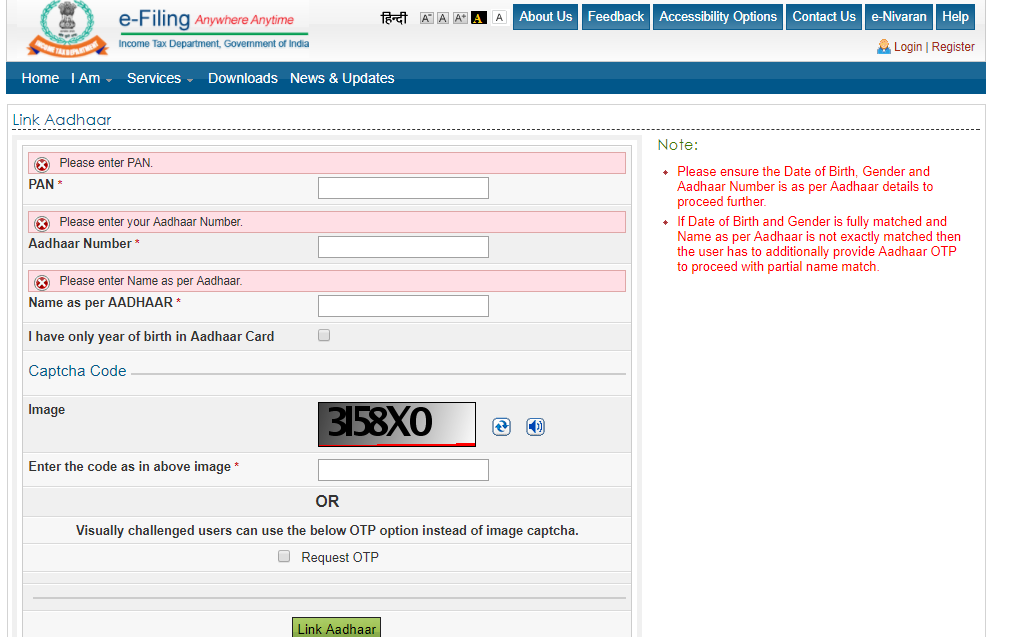

- After that fill the form with required details of PAN, Aadhaar Number followed by the name exactly written on Aadhaard Card with correct spelling. After that, tick only if your aadhaar card has the only birth year ( not the complete date of birth). Then, either enter the Captcha or mobile number for OTP verification. You need to choose one.

- Click on “Link Aadhaar” button after review the details filled by you. After verification, the linking will be confirmed from UIDAI (Government website for Aadhaar).

Points to be noted:

- Aadhaar OTP may be required in the case of any minor error or minor mismatch in Aadhaar name you provided.

- Once Aadhaar-PAN is linked, one can e-verify the IT return using Aadhaar if the mobile number is registered with Aadhaar database.

The linking Aadhaar card with PAN can be done after login to the income tax website. You can also pay using Aadhaar Card for any payments.

Corrections in PAN and Aadhaar Card

It is very rare if name or date of birth is different in PAN and Aadhaar. In case, if there is any mistakes or corrections in your PAN or Aadhaar Card, you can fix it by going to National Securities Depository Ltd. (NSDL). More detail is available at the following links

www.onlineservices.nsdl.com/paam/endUserRegisterContact.html and UIDAI portal https://ssup.uidai.gov.in/web/guest/update respectively.

Don’t have an Aadhaar card? Visit the official website to apply! uidai.gov.in

| आधार कार्ड को PAN Card से कैसे लिंक करें |

Now a days, mandatory to link your mobile number to Aadhaar card as per the Government order.